For more details and information ,Please contact

89789 44541

or

insuresafetech@gmail.com

The Right to Health as " The enjoyment of the highest attainable standard of Health "

For more details and information ,Please contact

89789 44541

or

insuresafetech@gmail.com

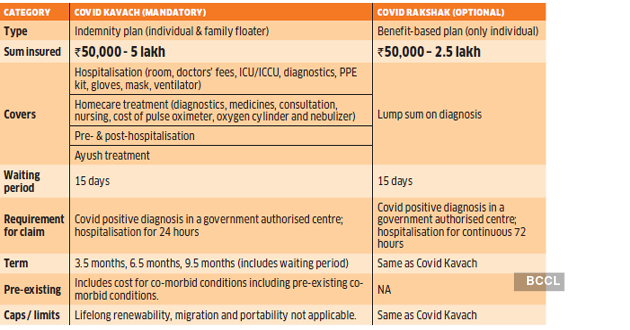

The biggest difference is that in Corona Kavach Policy only the hospital bill gets reimbursed as it is an indemnity-based plan but in Corona Rakshak Policy, the 100 per cent of the sum insured is paid to the policyholder as it a benefit-based plan.

Corona Kavach Policy: IRDAI had recently mandated insurance companies to offer short-term health plans that will cover hospitalisation expenses related to the treatment of COVID-19. This will help individuals buy specific health cover for meeting hospital costs due to coronavirus. Both Corona Kavach Policy and Corona Rakshak Policy are health insurance plans meant for Covid-19 related hospital expenses.

There are at least two benefits of such exclusive COVID-19 health plans:

i) The no-claim bonus on existing health insurance plans is not immediately impacted and

ii) One need not continue to pay premium till lifetime as they are short-term plans.

But, before you buy them, know 7 differences between the two plans.

Corona Kavach Policy, the COVID Standard Health Policy need to be compulsorily offered by all general and health insurance companies and life insurance companies cannot offer them. To buy Corona Rakshak Policy, one may approach any insurer including the life insurance company.

Corona Kavach Policy is to being offered by 29 insurers from July 10. As far as Corona Rakshak Policy, the standard benefit-based health policy is concerned, the IRDAI had asked insurers to launch them preferably before July 10, however, it remains to be seen when they start launching them.

The minimum sum insured for Corona Kavach Policy is Rs 50,000 and the maximum is Rs 5 lakh while for the Corona Rakshak Policy, the minimum sum insured is Rs. 50,000 and the maximum limit shall be Rs.2.5 lakh.

In the Corona Kavach Policy, the base coverage or the sum insured will apply only when there is a hospitalization of a minimum period of 24 hours. The hospital expense up to the sum insured will be paid as claim by the insurer irrespective of the days of stay in the hospital. But, in the case of Corona Rakshak Policy, it requires hospitalization for a minimum continuous period of 72 hours.

The Corona Kavach Policy shall have One Basic mandatory cover and One Optional Cover. The premium payable towards this Optional Cover will have to be paid separately so as to enable policyholders to choose and pay based on the need. The Base Cover of Corona Kavach Policy will be offered on Indemnity basis whereas Optional Cover shall be made available on Benefit Basis.

In an indemnity cover, the claim is paid as per the hospital bills while in a Benefit cover, the entire sum insured is paid to the policyholder.

“While Corona Kavach is an indemnity based plan that reimburses policyholders based on medical expenses incurred for treatment of COVID, Corona Rakshak is a benefit plan that offers fixed compensation upon the patient being diagnosed with COVID and being hospitalized for 72 hours, irrespective of the medical expenses incurred"

One can buy Corona Kavach both on an individual basis and on Family Floater basis but Corona Rakshak is offered on an individual basis only and hence no Family Floater option is available in it.

The Corona Kavach Policy gives one the option to add ‘Hospital Daily Cash’ cover. Under it, the insurer will pay 0.5 per cent of the sum insured per day for every 24 hours of continuous hospitalization for treatment of COVID following an admissible hospitalization claim under this policy. The benefit shall be payable maximum up to 15 days during a policy period. However, there is no such feature in Corona Rakshak policy as it is entirely a benefit-based plan.

In both policies, co-morbidity arising out of treatment in Covid-19 is also covered, so it is better to keep a high cover. Being a short plan and the ongoing incident of the virus, it's better to choose a longer term and high sum assured. But do not ever consider it as a substitute for a regular health insurance plan. “The policy should not be considered as a substitute for a comprehensive health cover. In case you do not have basic health cover, this policy can help provide specific cover with regards to any medical expenses towards the treatment of COVID-19, at an affordable price. In case you already have a health insurance policy, you can purchase this policy as a supplementary cover".

For more details and information ,Please contact

89789 44541

or

insuresafetech@gmail.com

COVID-19 or more commonly known as the Novel Coronavirus has brought the entire world to a standstill. With the cases of Coronavirus infections increasing at an alarming rate, several nations continue to be in a state of lockdown even more days. As of now reaching 13 million confirmed cases and 5, 78,000 deaths have been recorded due to this unprecedented pandemic across the world. We as a nation have also been severely impacted due to the Corona virus outbreak,with

3,04,576 active cases and 23,440 deaths as of June 13, 2020. In these

trying times, the Indian Government has taken and is actively taking necessary

measures to ensure that continuous medical care is available to the Indian

citizens and the spread of COVID-19 is contained.

Considering the gravity of the situation, the Insurance Regulatory and

Development Authority of India (IRDAI) had also issued an advisory to insurance

companies to expedite the processing of claims made in relation to COVID-19

pandemic. In light of this directive, all existing health insurance policies would extend their coverage

to include Coronavirus without having any specific exclusion. That means if

you already have a health insurance policy in place, you will be covered for

claims related to Coronavirus disease.

All claims related to

Corona virus will be managed as per the below-mentioned norms:

· The policy will cover you for the hospitalization costs related to Coronavirus disease;

· The policy will also cover the medical expenses incurred during the treatment of the disease;

· Additionally, all medical expenses occurred during the quarantine period will be reimbursed by the insurance provider.

All guidelines relating to Coronavirus are effective April 30, 2020 and

have been released through a circular “Guidelines

on handling of claims reported under Corona Virus, Ref. No:

IRDAI/HLT/REG/CIR/054/03/2020”. The guidelines are dictated by

Section 14(2)(e) of the IRDAI Act, 1999.

What should you do?

With the Corona virus pandemic creating an alarming situation, a Coronavirus

health insurance policy can keep you financially secured. While the Coronavirus

health insurance policy may be a good option for the time being, it might leave

you vulnerable after a year. Moreover, you would remain without a cover for all

other ailments and treatments.

Hence, an ideal solution would be to consider having a regular health insurance plan. This will ensure that you are adequately covered for various forms of diseases and the required treatments, including COVID-19.

Whether you choose a COVID-19 specific policy, or a broader health

insurance plan, or even if you already have a health insurance policy, make

sure to inform your insurance provider at the earliest in case you happen to be

diagnosed with Corona virus disease or related symptoms. All the cases related

to Corona virus will be expedited and addressed with care by the insurance

providers.

In effect, this is a good time to

take stock of your healthcare needs and make sure that you are

adequately prepared. A comprehensive health insurance policy is your best

shield against healthcare uncertainties and the rising medical inflation.

For more information and advice

Please contact

8978944541

insuresafetech@gmail.com